Frequently Asked Questions: Zippy Borrower Portal

- How Do I Register for the Borrower Portal?

- Loan Details & Balances

- Loan Payment History

- Viewing Loan Documents

- Loan Calculator

- Requesting Loan Payoff

- Help & Contact Us

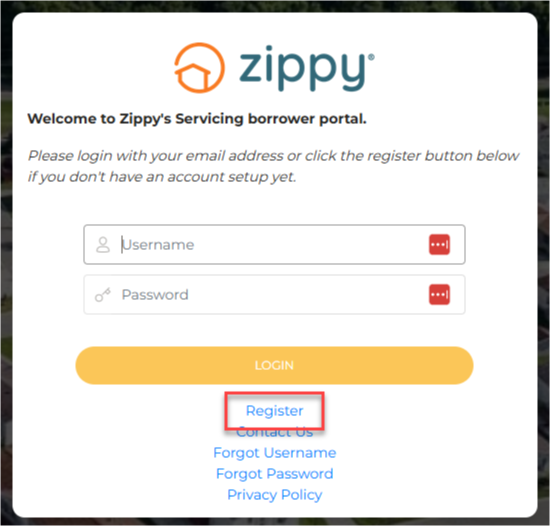

How Do I Register for the Borrower Portal?

1. Go to www.zippymh.com/portal using a computer, tablet, or smartphone.

2. Click the “Register” button beneath the orange "Login" button.

3. You will see a security image with some letters or numbers. Type them exactly as you see them and click “Submit.”

4. Next, you will be asked to enter your loan number and your full Social Security Number (SSN). Then click “Register.”

5. Read the license agreement that appears. To continue, scroll down and click “I Agree.”

6. Create your account:

- Choose a username (we recommend using your email address).

- Create a password and confirm it.

- Enter your email address and confirm it again.

- Click the green “Register” button.

Helpful Tip: Your username and password should be between 4 and 25 characters long.

7. Once you complete the steps correctly, you will see a message saying your account has been created.

8. Very important: Go to your email inbox and look for a message from Zippy. Click the “Click To Activate” link in that email to finish setting up your account.

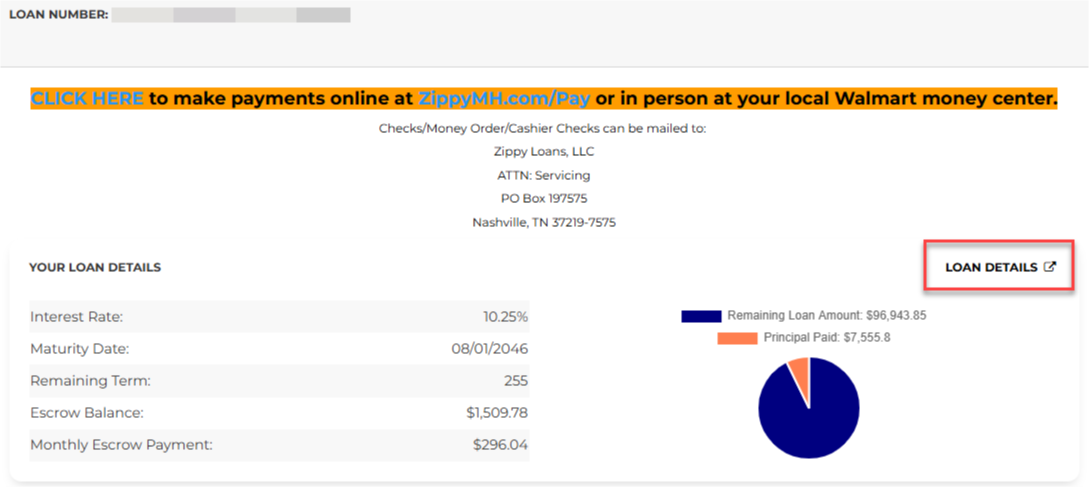

How Can I See My Loan Details and Balance?

1. Sign in at www.zippymh.com/portal.

2. The home page will show basic information like:

- Loan amount

- Interest rate

- Payment due date

- How much you still owe

3. To see more details, click “Loan Details” on the right side of the screen.

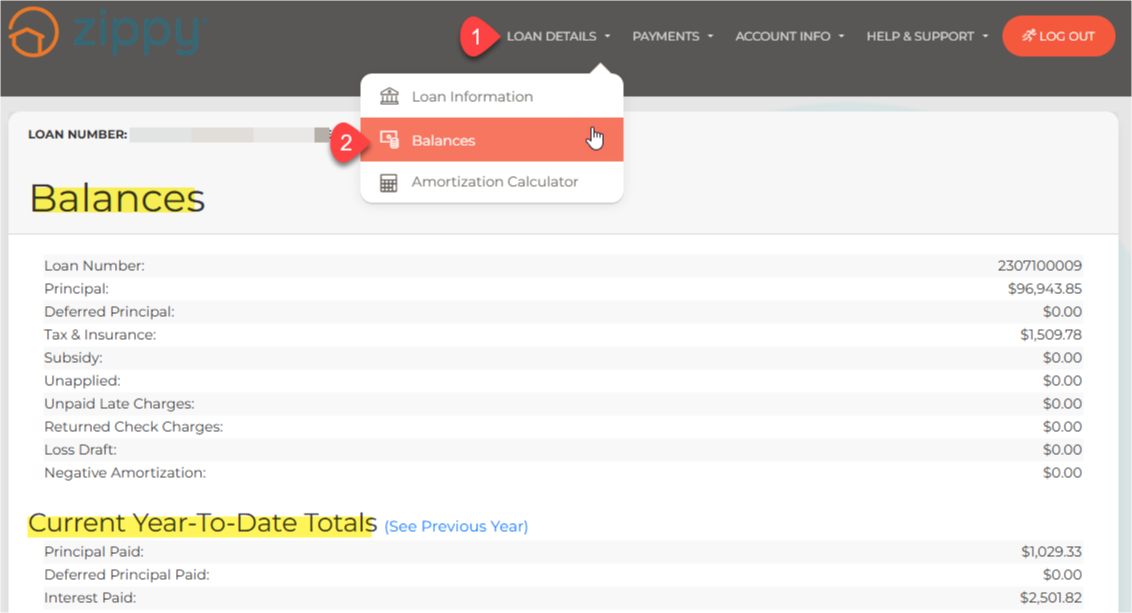

4. To see a breakdown of your balance and what you’ve paid so far, click “Balances” under the “Loan Details” menu at the top of the page.

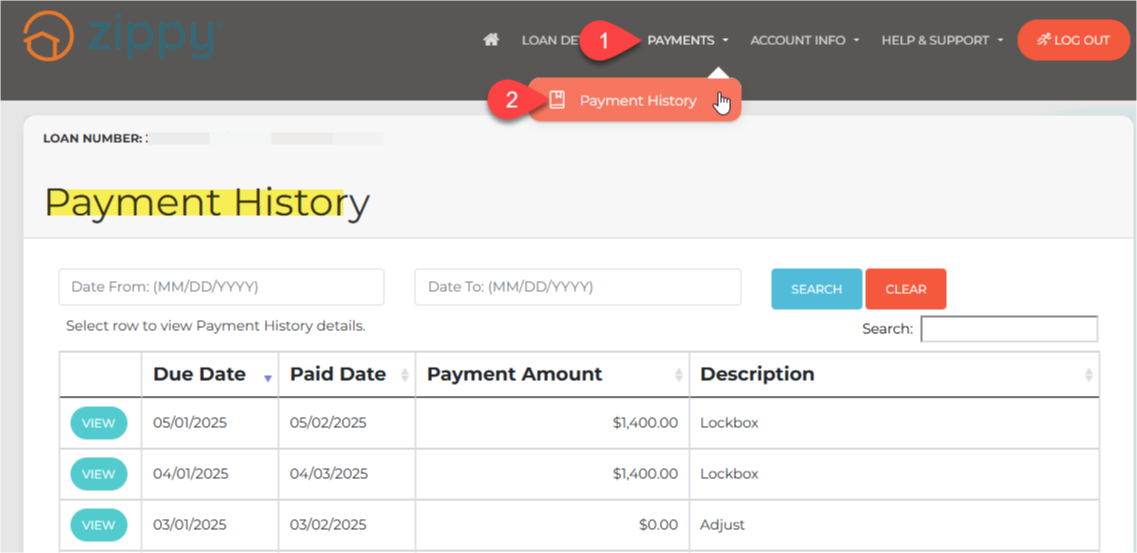

How Do I View My Payment History?

1. Sign in at www.zippymh.com/portal.

2. At the top, find the “Payments” tab and click “Payment History.”

3. You’ll see a list of past payments, including the date and amount.

4. Click “View” next to any payment to see more details about how your payment was used (such as toward interest, principal, or fees).

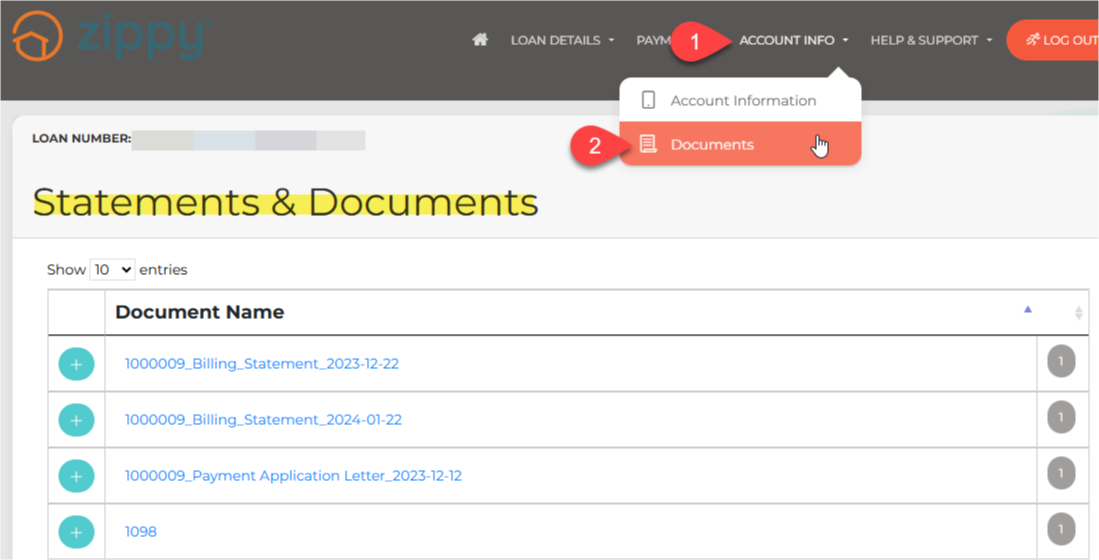

How Do I See My Loan Documents?

1. Sign in at www.zippymh.com/portal.

2. At the top, click on “Account Info” and then choose “Documents.”

3. You’ll see several types of documents, including:

- Monthly loan statements

- Tax forms (such as Form 1098)

- Insurance records

- Escrow details and more

Click on any document to open and review it.

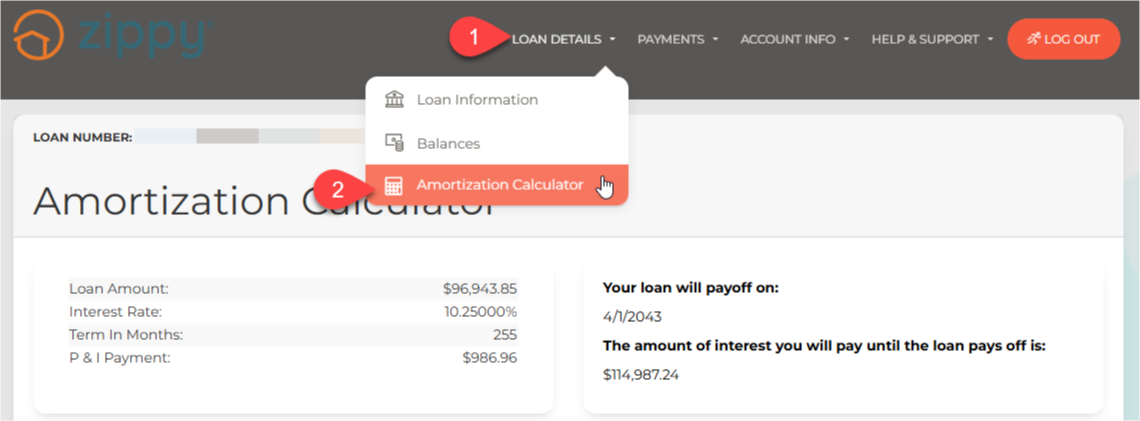

How Can I See My Loan Payoff Schedule or Try Out Extra Payments?

1. Sign in at www.zippymh.com/portal.

2. At the top of the screen, from Loan Details, select Amortization Calculator.

3. Here you can view your current loan payoff date and the amount of interest you will pay with that date.

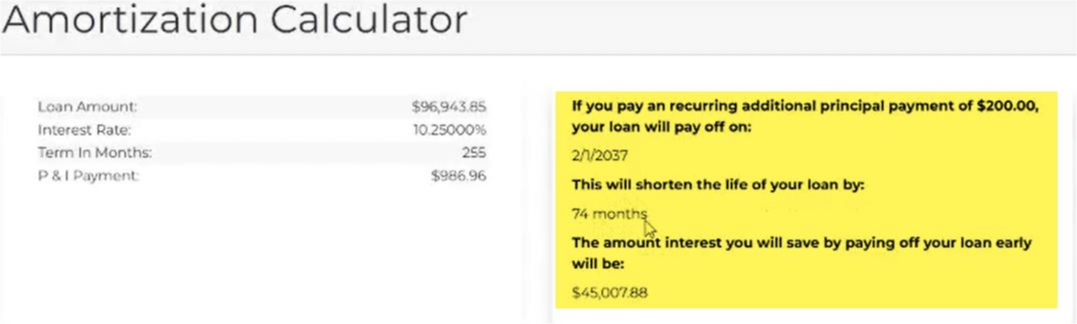

4. This tool can be used by Borrowers to calculate what their loan would be advanced to if they paid more on their principal.

- Additional Monthly:

- Adjust the scroll bar for either Recurring Additional Principal/One Time Additional Principal or enter a dollar value to add to the principal.

- Click Calculate.

- Once updated, the top of the screen will show the adjusted pay off date and amount of interest that would be saved by paying this additional amount towards principal.

- Additional Annual

- Click the Annual Additional Principal box.

- Adjust the scroll bar for Annual Additional Principal or enter a dollar amount.

- Click Calculate.

- View the updated payoff date and interest saved at the top of the screen.

5. The Amortization Schedule can be viewed and printed from the link at the bottom of the screen.

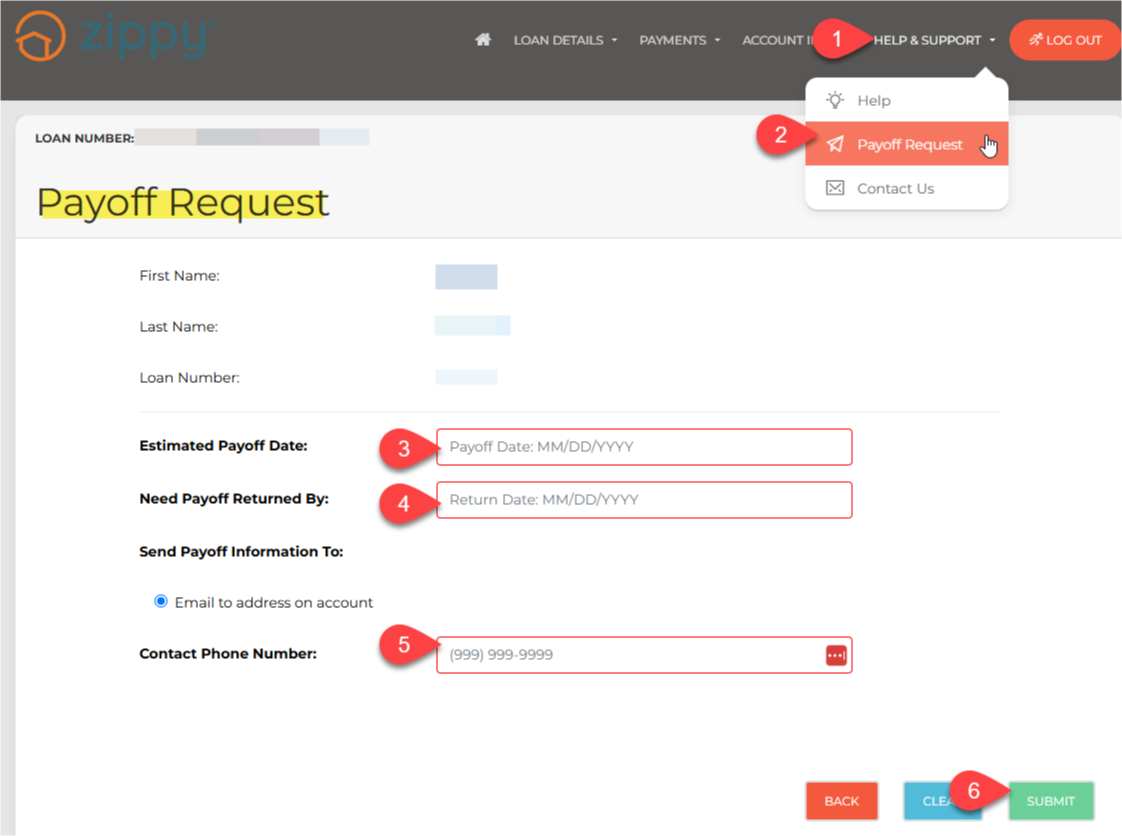

How Do I Request a Loan Payoff Amount?

1. Sign in at www.zippymh.com/portal.

2. Click on “Help & Support”, then choose “Payoff Request.”

3. Fill out the short form:

- Enter the date you think you will pay off the loan

- Enter the date you need the payoff amount by

- Enter your phone number

4. Click “Submit”

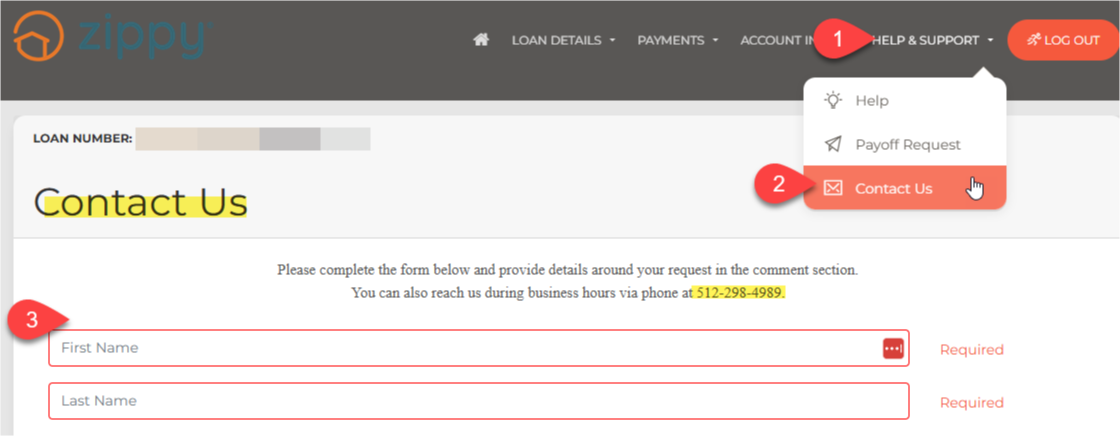

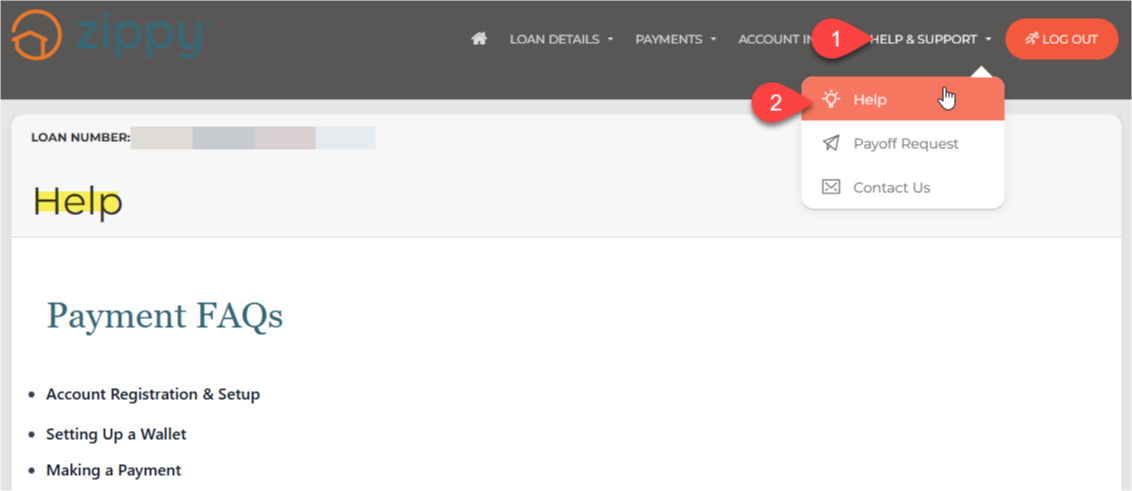

Where Can I Get Help or Contact Support?

1. After logging in, click “Help & Support” at the top.

2. Select “Help” to find:

- Frequently Asked Questions (FAQs)

- How to set up auto-pay

- Glossary of common loan terms

- Types of accepted payment methods

3. Still need help? Click “Contact Us.”

- You can fill out a form or call us during business hours using the phone number shown.